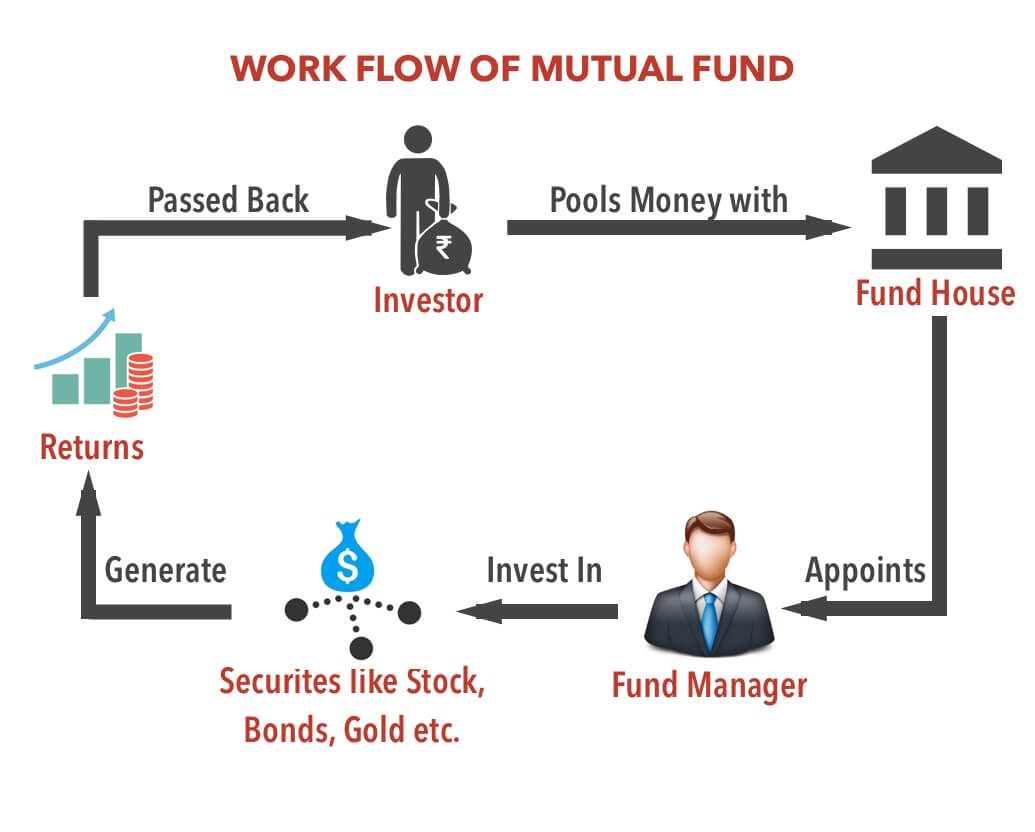

A Mutual Fund is a special way for people to invest their money together. Here is how it works: many investors give their money to a company called an Asset Management Company (AMC). This AMC collects all the money and appoints fund managers, who are experts in selecting investments like company shares (stocks), government and company bonds, and other assets. Each investor gets “units” of the fund, which represent your share in the whole pool. The value of your units goes up or down as the value of the fund’s assets changes.

A Mutual Fund is a special way for people to invest their money together. Here is how it works: many investors give their money to a company called an Asset Management Company (AMC). This AMC collects all the money and appoints fund managers, who are experts in selecting investments like company shares (stocks), government and company bonds, and other assets. Each investor gets “units” of the fund, which represent your share in the whole pool. The value of your units goes up or down as the value of the fund’s assets changes.

In India, Mutual Funds are very popular because they are easy to use, don’t require expert knowledge, and allow even small investors to take part in the stock market or debt markets. You can choose from many types of Mutual Funds, look at the Mutual Fund benefits, think about the possible Mutual Fund risks, and once you learn how to invest in Mutual Funds, you get many new ways to reach your financial goals. Whether you are saving for your child’s education, a new home, or retirement, the best Mutual Funds can help your money grow.

Why More Indians Trust Mutual Funds

As India’s middle class grows and more people think about saving and investing, Mutual Funds have become one of the most popular options. There are a few key reasons:

Expert Help: You don’t have to be a financial brain. Experienced fund managers take all the investment decisions for you.

Diversification: Your money is spread over many shares, bonds, or other investments. Even if some lose value, others may go up, so you’re protected from “all eggs in one basket” risk.

Easy to Start: You can begin with just Rs.500/- or even less as a SIP (Systematic Investment Plan).

Transparency and Safety: SEBI (Securities and Exchange Board of India) regulates all Mutual Funds in India, so your money is protected by law and you get full details in plain language.

Flexibility: Most Mutual Funds let you buy or sell your units whenever you wish (except for some with lock-in like ELSS funds).

This convenience, safety, and expert management are some of the biggest Mutual Fund benefits that make them ideal for Indian investors at every stage of life.

Types of Mutual Funds in India

India’s Mutual Fund industry offers several different types, so you can match your fund to your needs and comfort with risk:-

-

Equity Mutual Funds: Invest mostly in shares of companies. Give the chance of high returns but can also go up and down quickly (higher risk).

-

Debt Mutual Funds: Invest mainly in government bonds, company bonds, and fixed-income assets. Safer and less volatile, but returns may be lower than equities.

-

Hybrid Mutual Funds: Mix of equity and debt. Good for those wanting balanced risk and return.

-

Index Funds: Track a stock market index like the Sensex or Nifty. Usually have lower fees.

-

ELSS Funds (Equity Linked Savings Schemes): Invest in stocks and also save tax under Section 80C, but money is locked for three years.

-

Liquid Funds: Invest in very safe and short-term bank and company debts. Perfect for parking money or emergencies.

-

Sector/Thematic Funds: Focus on one sector (like IT or Pharma). Can bring high rewards or losses depending on that sector’s performance.

Pick the type that matches your financial goal, how much risk you are okay with, and your investment timeframe.

How Do Mutual Funds Work?

You and thousands of others invest your money in a Mutual Fund. The AMC’s fund manager puts all this money into shares, bonds, or a mix of both, as per the fund’s aim. The value of the fund changes every day as stock prices rise or fall, or as bonds earn interest. You own a few “units” of the fund (like shares in a company). The value of your investment is called the Net Asset Value (NAV), which updates daily. If the fund’s investments do well, NAV rises and your investment grows. If the fund does poorly, the NAV can fall. You can usually add money any time, take out money when you need (except for some lock-in funds), and check your fund’s value online or with your AMC.

You and thousands of others invest your money in a Mutual Fund. The AMC’s fund manager puts all this money into shares, bonds, or a mix of both, as per the fund’s aim. The value of the fund changes every day as stock prices rise or fall, or as bonds earn interest. You own a few “units” of the fund (like shares in a company). The value of your investment is called the Net Asset Value (NAV), which updates daily. If the fund’s investments do well, NAV rises and your investment grows. If the fund does poorly, the NAV can fall. You can usually add money any time, take out money when you need (except for some lock-in funds), and check your fund’s value online or with your AMC.

What to Check Before You Invest

Before putting your money in any Mutual Fund, consider these important points:

-

Your goal: What are you saving for? (e.g., child’s education, a new house, wedding, retirement, etc.)

-

Risk comfort: Are you okay if your investment value goes up and down, or do you want steady and safe growth?

-

Investment period: Will your money stay for short-term (up to 3 years), medium-term (3-5 years), or long-term (more than 5 years)?

-

Costs (Expense Ratio): Check if the fund’s fees are low; high fees cut your returns.

-

Performance history: Review how the fund did in the last 3, 5, and 10 years. Don’t go just by last year’s result.

-

Fund manager’s record: Good fund managers with years of experience often lead to more stable performance.

-

Exit load/lock-in: Some funds charge a fee if you withdraw early or keep your money locked for some time.

These checks will help you avoid common Mutual Fund risks and select the best Mutual Funds for your needs.

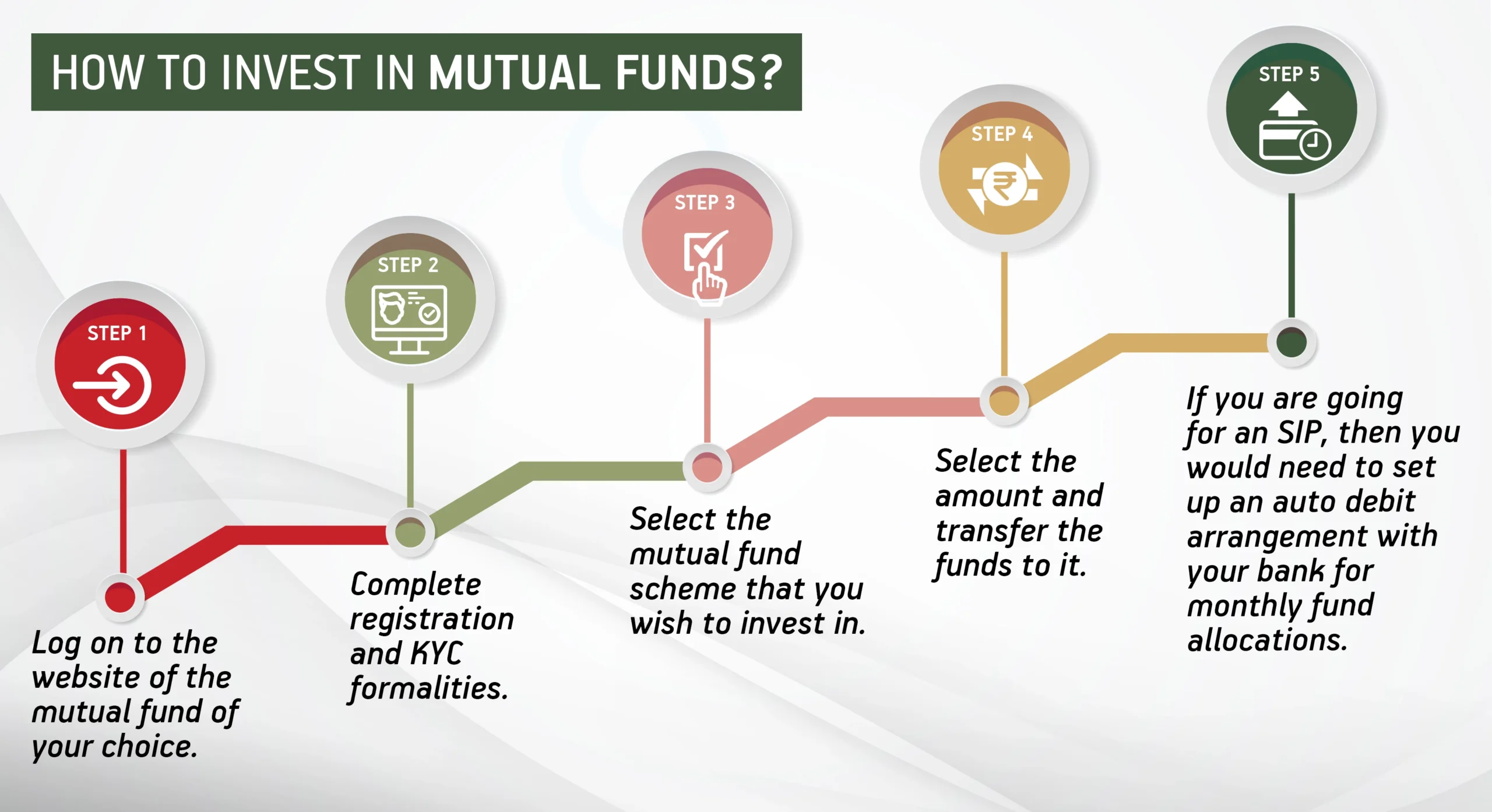

How to Invest in Mutual Funds

Investing in Mutual Funds in India is now very easy and mostly online. First, decide your investment goal and how long you want to invest. Then, check your risk comfort and decide which type of Mutual Fund suits you. Start the process by completing your KYC (Know Your Customer) requirements, which only needs your PAN, Aadhaar, and address details. Open an account with the AMC, a Mutual Fund platform/app, or even your bank. Today, popular apps like Groww, Zerodha, or Paytm Money make this simple for everyone. Choose whether you want to invest a lump sum (big amount in one go) or SIP (Systematic Investment Plan, small amounts regularly). For most people, SIP works best because it forms a habit and reduces risk from market ups and downs. Finally, submit your investment online or offline. You’ll get a confirmation, and then you can log in to check your fund’s value anytime. Review your investments every six months or once a year. As your life goals or risk comfort changes, you can easily switch funds or move your money.

Investing in Mutual Funds in India is now very easy and mostly online. First, decide your investment goal and how long you want to invest. Then, check your risk comfort and decide which type of Mutual Fund suits you. Start the process by completing your KYC (Know Your Customer) requirements, which only needs your PAN, Aadhaar, and address details. Open an account with the AMC, a Mutual Fund platform/app, or even your bank. Today, popular apps like Groww, Zerodha, or Paytm Money make this simple for everyone. Choose whether you want to invest a lump sum (big amount in one go) or SIP (Systematic Investment Plan, small amounts regularly). For most people, SIP works best because it forms a habit and reduces risk from market ups and downs. Finally, submit your investment online or offline. You’ll get a confirmation, and then you can log in to check your fund’s value anytime. Review your investments every six months or once a year. As your life goals or risk comfort changes, you can easily switch funds or move your money.

Pros and Cons of Mutual Funds

Let’s make it clear, Mutual Funds are good for most investors, but they are not perfect:

Pros:

-

Managed by financial experts

-

Diversification across many investments reduces your risk

-

Can start with very small amounts

-

Easy to buy, sell, or switch between funds

-

Well-regulated and safe for Indian investors

Cons:

-

Value can go up or down daily; nothing is guaranteed

-

Charges (fees) reduce your profit

-

Some funds lock your money for a fixed period (like ELSS)

-

Too many funds and choices can be confusing for new investors

Knowing both sides will help you plan your investments better.

Common Myths About Mutual Funds

Many Indians think Mutual Funds are only for rich people or financial experts. That is not true. Anyone can begin investing, even if you are a college student or homemaker. Some think Mutual Funds are very risky. Actually, you can pick low-risk debt or hybrid funds if you are a safe investor. Another myth is that you must pay a big amount—SIPs can start as low as Rs. 500 a month.

Many Indians think Mutual Funds are only for rich people or financial experts. That is not true. Anyone can begin investing, even if you are a college student or homemaker. Some think Mutual Funds are very risky. Actually, you can pick low-risk debt or hybrid funds if you are a safe investor. Another myth is that you must pay a big amount—SIPs can start as low as Rs. 500 a month.

Some say you cannot stop your investment once you begin. In most funds, you can pause or stop anytime. And people believe that SIPs must be monthly; in reality, you can set up SIPs weekly, fortnightly, monthly, or quarterly, whatever suits your salary cycle.

Smart Strategies for Maximizing Your Mutual Fund Returns

-

Stay invested for the long term to really benefit from compounding returns.

-

Spread your risk—have 2-4 funds from different types (for example, one equity, one debt, one hybrid).

-

Don’t panic if markets fall; avoid selling in a hurry unless your goal changes.

-

Check your portfolio yearly, and if a fund is doing poorly for many years, think about switching.

-

Prefer direct plans if you can manage your own investments; they charge lower fees than “regular” plans.

-

Let your dividends be reinvested for greater growth, unless you need the income.

Mutual Funds and the Indian Economy

Mutual Funds help Indians join the country’s growth story. When you invest, your money goes to companies, the government, or banks, helping them build roads, schools, factories, and tech. With Mutual Funds, families get wealth growth and the country gets savings that push it ahead. That’s why India’s Mutual Fund industry has grown almost twenty times in the last decade!

From small towns to big cities, more people are now trusting Mutual Funds for everything from child education planning to building that dream home. Learning about the types of Mutual Funds and how to invest means you can join this movement too.

FAQs on Mutual Funds

1. Are Mutual Funds safe for beginners?

Yes. They are regulated and you can pick safer types like debt or index funds.

2. How much do I need to start?

You can begin a SIP with just ₹500 a month.

3. Can I stop my SIP any time?

In most open-ended funds, yes—simply use your app or call the AMC customer care.

4. Will my money be locked?

Not for most funds. Only tax-saving funds (ELSS) have a three-year lock. Double-check before you invest.

5. Where can I track my Mutual Fund?

Use mobile apps, the AMC’s website, or investment statements sent on email.

Conclusion

A Mutual Fund is an excellent tool for Indian investors who want to grow their money safely, with expert help, and with very little effort. The types of Mutual Funds suit every kind of person, from the careful saver to the brave risk-taker. Understand the benefits and possible risks, check the fund details wisely, and follow the right steps on how to invest in Mutual Funds for the best results. Be patient, keep learning, and let the power of teamwork and expert management start building your dreams today, one SIP, one fund, and one rupee at a time.