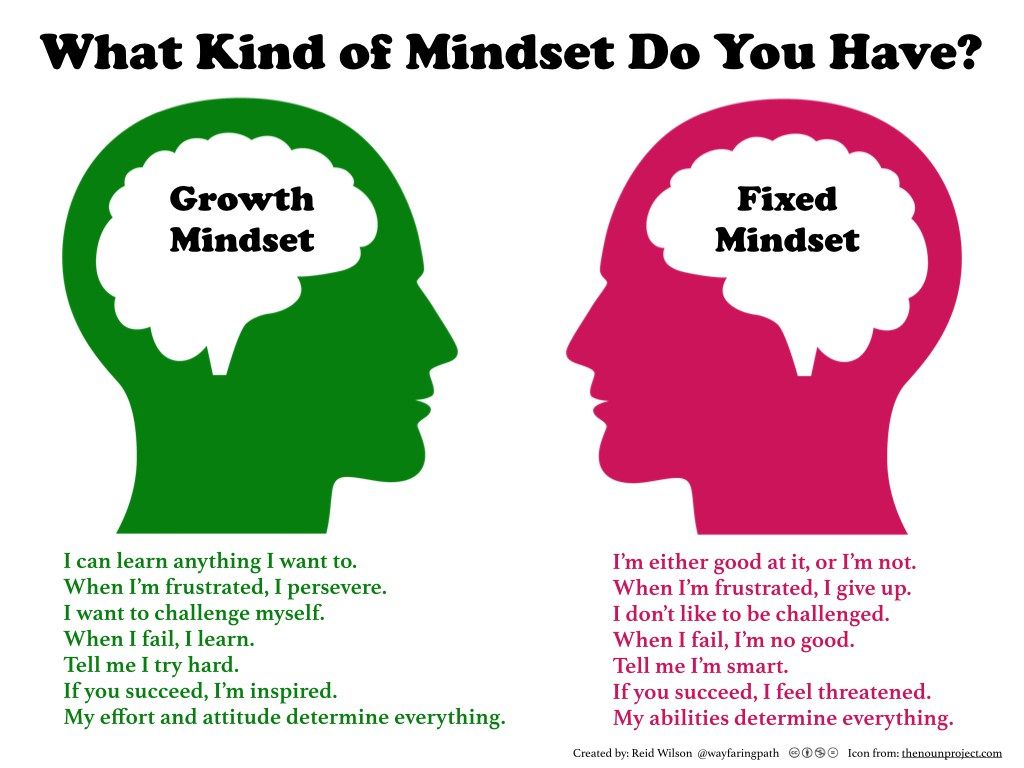

The stock market has always triggered debates among experts and beginners alike. Some people enter it with the hope of becoming millionaires overnight, while others treat it like a professional tool for long-term financial growth. This split in attitude raises the big question: is the stock market a game of luck or a serious business? The answer depends on your approach. The same platform that offers wealth to some can bring losses to others. So, your mindset and strategy make all the difference.

It’s essential to understand that the stock market is neither good nor bad on its own, it reflects your behavior. If you approach it with knowledge and discipline, it can reward you beyond imagination. But if you treat it like a betting table, you may suffer losses and blame the system. The truth is, success in the stock market isn’t about luck; it’s about learning, applying, and evolving just like in any other business.

Game-Like Mindset: Thrill Over Thinking

Game-Like Mindset: Thrill Over Thinking

Many new participants jump into the stock market with excitement, treating it like a casino. Their goal is to make quick money without understanding the risks or the fundamentals behind their trades. This approach may offer short-term highs but often results in long-term failures. For such people, investing becomes more of an emotional rollercoaster than a thoughtful process.

They tend to rely on:

- Tips from social media or friends

- Short-term news hype

- Impulsive buying and selling

- Ignoring stop-loss or safety measures

- Chasing penny stocks and volatile trades

Such actions are fueled by greed and fear. When a trade succeeds, they feel like winners. When it fails, they blame the market or the government. But in reality, they never developed a long-term view or proper understanding. This group treats the stock market like a game and eventually burns out.

Business-Minded Approach: Strategy and Structure

On the other hand, there are investors who treat the stock market like a full-fledged business. They do not gamble with their capital. Instead, they follow a structured investment plan that aligns with their long-term financial goals. Just like a businessperson studies the market, understands customer demand, manages costs, and thinks about profitability, these investors think of stocks as ownership in actual companies.

On the other hand, there are investors who treat the stock market like a full-fledged business. They do not gamble with their capital. Instead, they follow a structured investment plan that aligns with their long-term financial goals. Just like a businessperson studies the market, understands customer demand, manages costs, and thinks about profitability, these investors think of stocks as ownership in actual companies.

Key traits of business-minded investors include:

- Researching financials of companies

- Understanding sectors and economic cycles

- Diversifying their portfolio

- Measuring risk and setting goals

- Following a disciplined entry and exit strategy

They don’t panic during market dips, and they don’t chase every rally. Their confidence comes from preparation, not luck. Over time, this approach not only protects their capital but also helps them grow their wealth steadily.

Learn More: Difference Between SIP Vs Mutual Fund

The Key Differences: Game vs. Business

The approach defines the experience. Let’s compare how each type of person thinks and acts in the stock market.

Game Players:

- Chase market trends blindly

- Invest without research

- Expect fast returns

- Trade emotionally

- Exit after losses

Business Thinkers:

- Conduct deep company analysis

- Plan entries and exits carefully

- Focus on risk management

- Stay invested through ups and downs

- Build wealth slowly and surely

The contrast is crystal clear. The stock market is the same for everyone, it is the behavior and perspective that make it either a gamble or a business opportunity.

Read More: Who is stock Broker in Stock Market?

Stories from Real Investors: Wisdom from the Legends

World-renowned investors like Warren Buffett, Rakesh Jhunjhunwala, and Peter Lynch never treated the stock market like a game. Instead, they saw it as a gateway to owning great businesses and growing wealth gradually. Let’s look at how these legends used a business mindset:

- Warren Buffett buys stocks only after understanding the business behind them. He once said, “I am a better investor because I am a businessman, and a better businessman because I am an investor.” He holds investments for decades and ignores short-term market noise.

- Rakesh Jhunjhunwala, often called India’s Warren Buffett, turned a small amount into thousands of crores by betting on strong businesses like Titan, not on market trends. He studied companies deeply and believed in India’s long-term growth story.

- Peter Lynch, former manager of the Magellan Fund, encouraged investors to “invest in what they know.” He combined research with a common-sense business approach, often spotting strong stocks early.

These investors succeeded because they approached the market with the seriousness of running a business.

Why Do People Fail in the Stock Market?

Most people who lose money in the stock market do so not because the market is unfair, but because they enter it unprepared. Emotional decisions, chasing tips, and lack of education are the biggest causes of failure. Treating it like a lottery rather than a business leads to common mistakes.

Most people who lose money in the stock market do so not because the market is unfair, but because they enter it unprepared. Emotional decisions, chasing tips, and lack of education are the biggest causes of failure. Treating it like a lottery rather than a business leads to common mistakes.

Here are some typical reasons why people lose money:

- No basic knowledge of stock investing

- Buying on hype, selling on fear

- Overtrading without purpose

- Lack of risk management strategies

- Not having a clear goal or timeframe

- Ignoring diversification

Such mistakes can be avoided simply by changing the mindset. If these individuals had approached the stock market as a business, they would have taken the time to learn, plan, and grow gradually.

Learn More: SIP (Systematic Investment Plan): 8th Worder of the World

How to Treat the Stock Market Like a Business

If you want long-term success, you must learn to treat the stock market like a real business. That means planning your investment journey like you would plan any enterprise.

If you want long-term success, you must learn to treat the stock market like a real business. That means planning your investment journey like you would plan any enterprise.

Here’s how to do it:

- Educate yourself – Read books like The Intelligent Investor and follow trusted financial content & attend Seminar/Webinar of Professional Traders/Investors.

- Define your capital – Know how much you can invest without affecting your personal life.

- Set clear goals – Are you investing for retirement, a house, or wealth creation?

- Track your results – Maintain records and learn from each trade.

- Control your emotions – Markets rise and fall, but panic never helps.

- Keep long-term vision – Businesses grow over time, and so do good stocks.

By applying these methods, you gain the discipline and insight required to navigate the stock market with clarity and purpose.

Final Thoughts: The Power Is in Your Mindset

So, is the stock market a game or a business? The answer lies in your own mindset. For gamblers, it becomes a game of chance filled with risk, uncertainty, and emotional stress. For disciplined investors, it becomes a vehicle for creating wealth and achieving financial freedom.

The market does not reward fast fingers or lucky guesses, it rewards those who think ahead, learn from mistakes, and grow over time. If you treat it with the seriousness of a business, the stock market can become one of the most powerful tools in your financial journey.