The bond market is a place where investors buy and sell bonds. A bond is like a loan that investors give to companies or governments. In return, they get interest after a fixed time. Just like people borrow money from banks, big companies and governments borrow money from the public through bonds. The bond market helps in this borrowing and lending process. It is also called the debt market or fixed-income market.

Understanding the bond market is very important for investors who want safe and steady returns. Unlike the stock market, bonds are usually less risky. Many people invest in bonds to earn regular interest income and protect their money. The bond market is very large and includes many types of bonds with different risk levels and returns.

If you are new to investing or looking to balance your stock portfolio, this blog will help you understand the bond market and how it works.

📌 Read More: What is Algo Trading?

How Does the Bond Market Work?

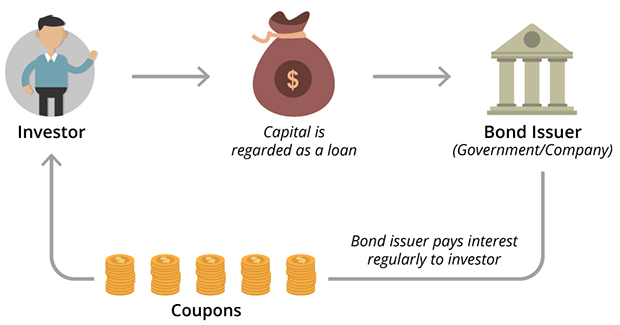

To understand what is bond market, let’s start with the basics of how it functions. When a company or government needs money, they can issue bonds instead of taking loans from banks. Investors buy these bonds, and the bond issuer promises to pay back the amount (called the principal) on a fixed date, along with regular interest payments (called coupons).

To understand what is bond market, let’s start with the basics of how it functions. When a company or government needs money, they can issue bonds instead of taking loans from banks. Investors buy these bonds, and the bond issuer promises to pay back the amount (called the principal) on a fixed date, along with regular interest payments (called coupons).

The bond market has two segments , the primary market and the secondary market. In the primary market, bonds are issued for the first time. In the secondary market, existing bonds are bought and sold among investors.

Bond prices can change in the secondary market depending on interest rates, demand, and credit ratings. If interest rates fall, old bonds with higher rates become more valuable. Understanding these market movements is part of knowing the bond market.

Why Do Investors Choose Bonds?

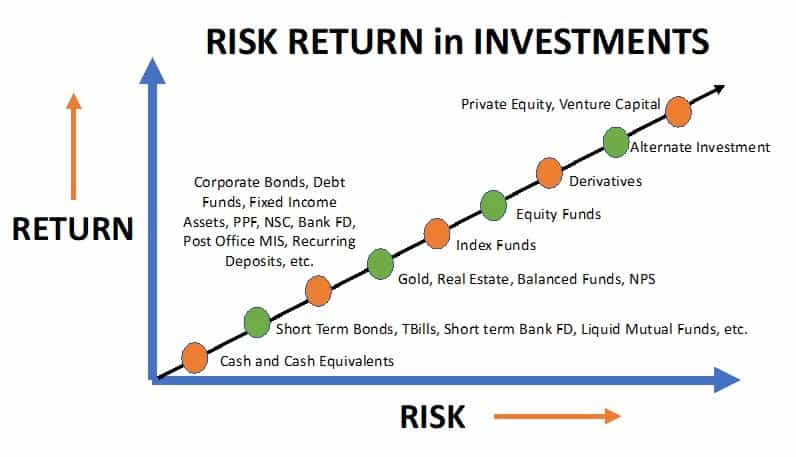

Now that you know the bond market, let’s look at why people invest in it. The biggest reason is stability and fixed income. Bonds offer a fixed rate of return, which is helpful during uncertain times. Older investors, retirees, or those looking for lower risk prefer bonds over stocks.

Now that you know the bond market, let’s look at why people invest in it. The biggest reason is stability and fixed income. Bonds offer a fixed rate of return, which is helpful during uncertain times. Older investors, retirees, or those looking for lower risk prefer bonds over stocks.

Another reason to choose the bond market is capital preservation. This means your money is safer compared to stocks. While stock prices can swing wildly, bonds are generally more predictable. Government bonds are especially safe.

Bonds also help in diversifying your investment portfolio. When stocks go down, bonds often hold steady or go up. So knowing the bond market can help you create a balanced investment plan.

📌 Read More: What is the ETF in Stock Market

Types of Bonds in the Bond Market

If you are exploring the bond market, you must know its types. There are many kinds of bonds available based on the issuer and features. Here are the main ones:

- Government Bonds: Issued by central or state governments. These are the safest, like RBI’s G-secs in India or U.S. Treasury bonds.

- Corporate Bonds: Issued by companies to raise capital. These carry more risk but offer higher returns.

- Municipal Bonds: Issued by local government bodies. In India, smart cities and infrastructure projects issue such bonds.

- Convertible Bonds: These can be converted into stocks after a certain time.

- Zero-Coupon Bonds: These do not pay interest regularly but are sold at a discount and give a lump sum on maturity.

Each type has its pros and cons. A smart investor who knows this market will choose bonds based on their risk level and return needs.

Bond Market vs Stock Market

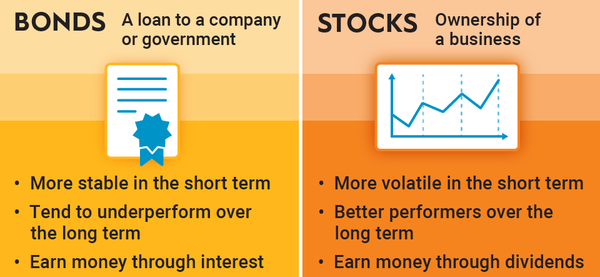

Many beginners ask how bonds differ from stocks. If you know this market, you’ll understand that bonds are safer and give fixed returns, while stocks are riskier but offer the chance for higher profits.

Here’s a quick comparison:

| Feature | Bond Market | Stock Market |

|---|---|---|

| Returns | Fixed Interest | Variable (Dividends + Price Gain) |

| Risk | Low to Moderate | High |

| Ownership | No (You are a lender) | Yes (You are a part-owner) |

| Volatility | Low | High |

| Income | Regular | Not Guaranteed |

While stocks suit aggressive investors, bonds are best for those seeking consistent and secure income. Understanding both helps in choosing the right mix for your goals.

📌 Read More: Investing in Real Estate: A Smart Way to Grow your Wealth

Risks in the Bond Market

Even though the bond market is safer, it still has risks. Knowing what is bond market also means knowing the dangers. Here are some key risks:

Even though the bond market is safer, it still has risks. Knowing what is bond market also means knowing the dangers. Here are some key risks:

- Interest Rate Risk: When interest rates rise, bond prices fall. If you sell before maturity, you may lose money.

- Credit Risk: If the company or government cannot repay, you may lose your investment.

- Inflation Risk: If inflation is higher than your bond interest, your real return goes down.

- Liquidity Risk: Some bonds are hard to sell quickly without losing value.

Therefore, it is important to check the credit rating and terms before buying any bond. A well-informed investor who knows the bond market will always evaluate risks carefully.

How to Invest in Bond Market in India

In India, investing in this market has become easier thanks to digital platforms and mutual funds. If you are curious about this market and how to invest, here are some ways:

In India, investing in this market has become easier thanks to digital platforms and mutual funds. If you are curious about this market and how to invest, here are some ways:

- Government Bonds via RBI Retail Direct: You can buy G-secs directly from the Reserve Bank of India.

- Bond Mutual Funds: These funds invest in a variety of bonds and are managed by professionals.

- Corporate Bonds via Stock Exchange: NSE and BSE list corporate bonds which you can buy like shares.

- Bond ETFs: These are exchange-traded funds that invest in bonds.

Online platforms like Zerodha, Groww, and GoldenPi allow retail investors to buy bonds easily. Before investing, always check yield, maturity date, and ratings.

Conclusion

In conclusion, understanding the market of bonds is crucial for every investor. It helps in earning fixed income, managing risk, and building a stable portfolio. While it may not offer the thrill of stock trading, it gives peace of mind and reliability.

Whether you are a beginner or experienced investor, bonds should be a part of your investment strategy. Learn the basics, compare types, and invest wisely. With time, this market can become your best friend in wealth creation and protection.

Keep learning about new financial tools, and never depend on just one type of investment. The smart way is to mix bonds, stocks, and mutual funds for long-term success.