Option Selling, also called option writing, is a method in stock market where traders sells options to earn a premium. It is different from buying options. When someone buys an option, they pay money (called a premium) to get the right to buy or sell a stock in the future. But when you sell an option, you collect that premium. This gives you an immediate income. Many experienced traders prefer option selling because it gives them a high chance of earning regularly. However, it also involves risks, which must be understood before trading.

👉 Read More: Option Buying in Stock Market

How Option Selling Works: Call and Put Options

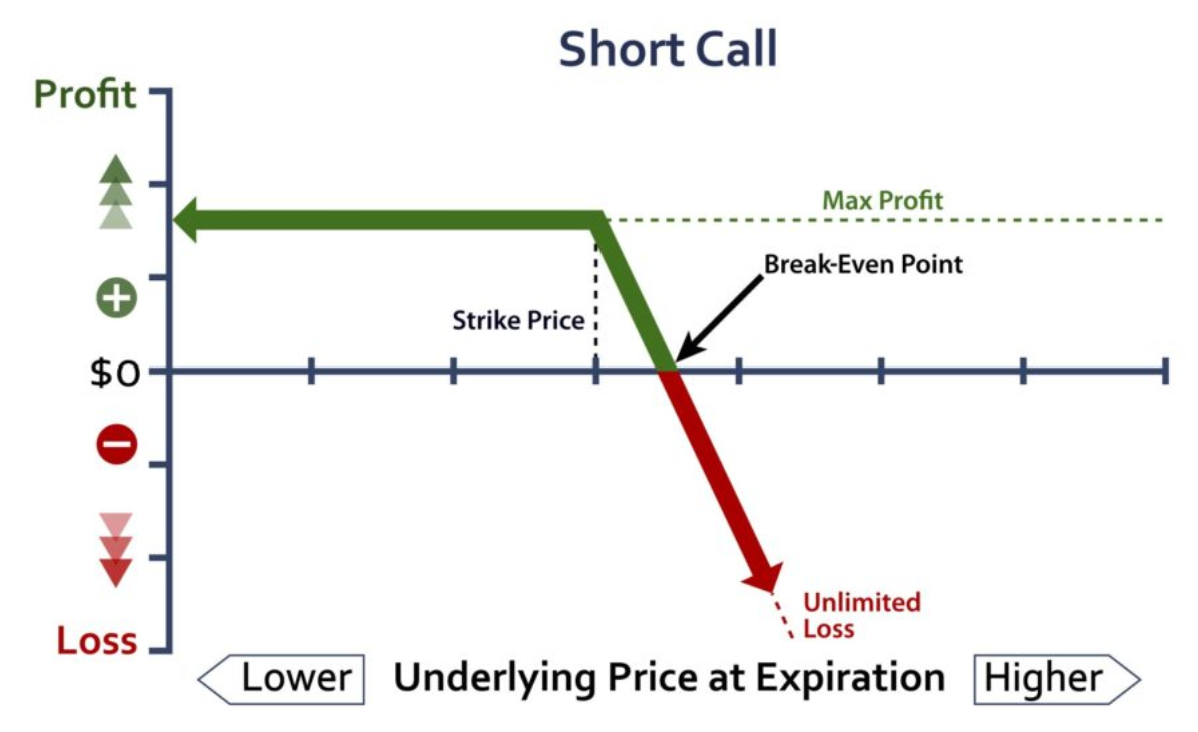

To understand option selling, we need to know about call and put options. A call option gives the buyer the right to buy a stock at a fixed price within a certain time. A put option gives the buyer the right to sell. When you sell a call option, you agree to sell the stock at a fixed price if the buyer chooses to exercise the option. On the other hand, when you sell a put option, you agree to buy the stock at a fixed price if the buyer decides to sell. In both cases, you are paid a premium for taking this risk. If the buyer does not use the option (which often happens), you keep the full premium as profit.

To understand option selling, we need to know about call and put options. A call option gives the buyer the right to buy a stock at a fixed price within a certain time. A put option gives the buyer the right to sell. When you sell a call option, you agree to sell the stock at a fixed price if the buyer chooses to exercise the option. On the other hand, when you sell a put option, you agree to buy the stock at a fixed price if the buyer decides to sell. In both cases, you are paid a premium for taking this risk. If the buyer does not use the option (which often happens), you keep the full premium as profit.

This method works well when the stock market is stable or moving in your favor. For example, if you sell a call option and the stock doesn’t go above the strike price, the buyer won’t use it, and you earn money without any action.

Why Option Selling is Popular Among Traders

Option Selling has become very popular for a few strong reasons. First, the success rate in option selling is often higher than buying. Most options expire without being used, which means sellers get to keep the premium. Second, it provides consistent income. Many traders sell options weekly or monthly to generate regular earnings, like a salary. Third, it suits sideways or range-bound markets very well, where prices do not move much.

Option Selling has become very popular for a few strong reasons. First, the success rate in option selling is often higher than buying. Most options expire without being used, which means sellers get to keep the premium. Second, it provides consistent income. Many traders sell options weekly or monthly to generate regular earnings, like a salary. Third, it suits sideways or range-bound markets very well, where prices do not move much.

Many full-time traders depend on this method as their main income source. It is not a get-rich-quick scheme but a patient strategy that can deliver long-term results. However, it requires skill, discipline, and proper planning.

👉 Read More: Intraday Trading: Quick Profits and Risks Explained

The Role of Premium in Option Selling

The premium is the main benefit of options selling. It is the amount paid by the buyer to the seller when the trade starts. This premium is yours to keep, no matter what happens later. If the option expires without being used (called “expiring worthless”), you keep the entire premium as profit.

Premiums are affected by factors like market volatility, time to expiry, and how far the strike price is from the current market price. Option Selling with higher premiums can give better returns but often come with higher risks. Smart traders balance risk and reward by selecting the right options with good premiums and lower chances of being exercised.

Managing Risks in Option Selling

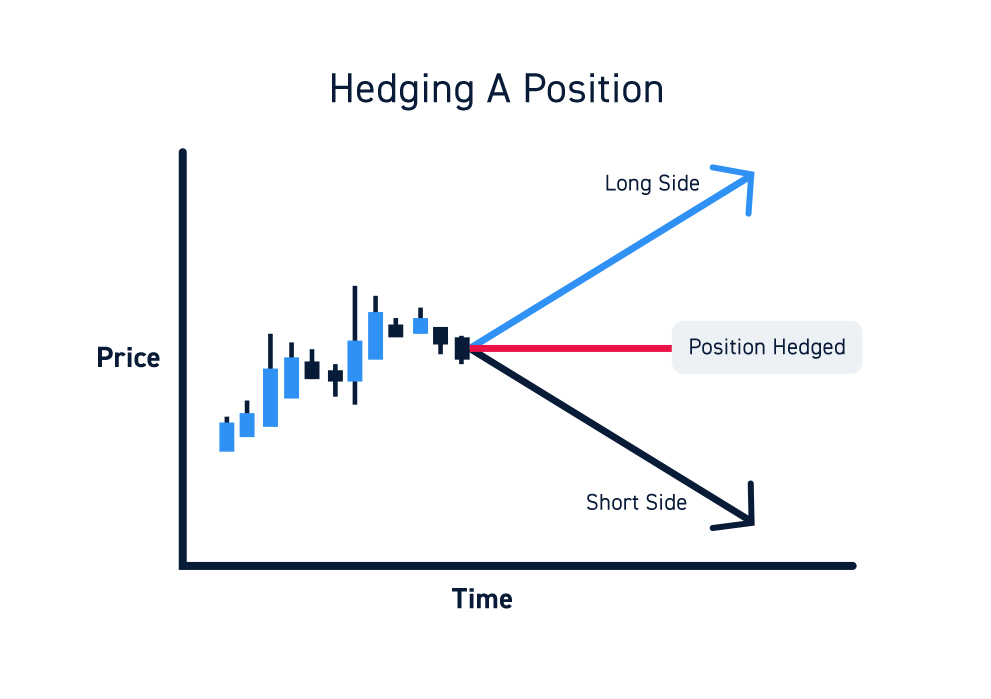

Although option selling offers regular income, it also comes with unlimited risk if the market moves sharply against your position. For example, if you sell a call option and the stock jumps high, your loss can be large. That’s why risk management is very important. Most of option sellers uses strategies like stop-loss orders, hedging, and position sizing to protect themselves.

Although option selling offers regular income, it also comes with unlimited risk if the market moves sharply against your position. For example, if you sell a call option and the stock jumps high, your loss can be large. That’s why risk management is very important. Most of option sellers uses strategies like stop-loss orders, hedging, and position sizing to protect themselves.

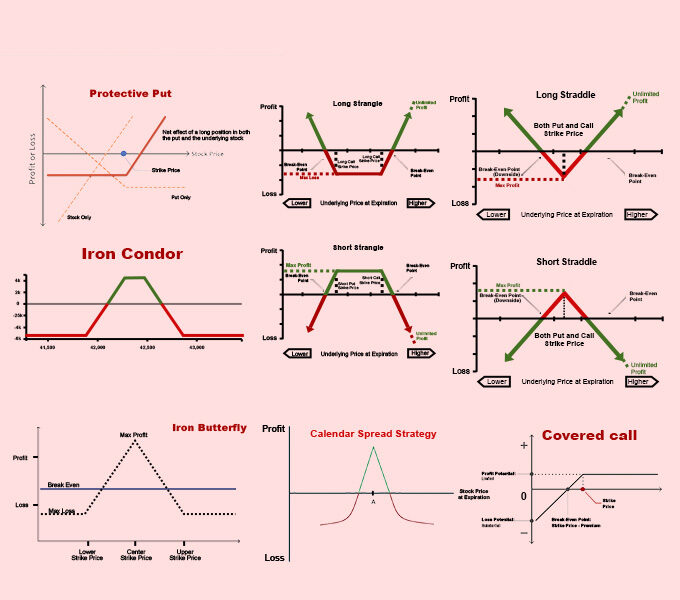

Using hedging techniques, such as combining call and put positions or using protective options, can reduce losses. It’s also smart to never put all your money into one trade. Risking only a small part of your capital in each trade is a safe way to build long-term success.

Margin Requirements and Capital Needed

For option selling, you need a margin account with your broker. This is because you are taking a financial risk and broker wants to ensure you can cover any losses. The capital needed for option selling is usually higher than option buying because the potential loss is greater.

However, there are ways to reduce margin needs. One method is to use credit spreads, selling one option and buying another to limit your loss. This helps you trade even with smaller capital. Always check your broker’s margin requirements before placing trades. Being aware of margin calls and managing your account wisely is key to staying in the game.

👉 Read More: Credit Card Is Like a Leech: Useful or Dangerous?

Common Strategies in Option Selling

There are several popular strategies used in option selling. Some of the most well-known ones are:

There are several popular strategies used in option selling. Some of the most well-known ones are:

- Covered Call: You own the stock and sell a call option. This gives you premium income plus stock benefits.

- Naked Put Selling: You don’t own the stock, but you sell a put. If the stock falls, you may have to buy it at the strike price.

- Iron Condor: This involves selling both call and put options with different strike prices to earn from a range-bound market.

Each strategy has its own risk-reward profile. You should choose one based on your market view, capital, and experience level. It is always better to start small and gain confidence before using complex strategies.

Taxes and Regulations on Option Selling

Earnings from option selling are considered business income in many countries, including India. This means the profit you make is added to your other income and taxed based on your income slab. Also, if you sell options regularly, you may have to maintain proper records, file Income Tax Returns (ITR), and sometimes even get your books audited depending on your turnover.

Earnings from option selling are considered business income in many countries, including India. This means the profit you make is added to your other income and taxed based on your income slab. Also, if you sell options regularly, you may have to maintain proper records, file Income Tax Returns (ITR), and sometimes even get your books audited depending on your turnover.

You must also follow exchange rules and broker guidelines while trading. Never try to avoid regulations as that may result in penalties. Make sure to speak with a tax consultant or CA who understands stock market taxation if you plan to trade in large amounts.

Is Option Selling Right for You? Final Thoughts

Option Selling can be a smart and rewarding strategy if done carefully. It offers regular income, high probability trades, and is suited for calm or sideways markets. However, it also demands discipline, knowledge, and strong risk control. It is not suitable for everyone, especially if you are emotional during market swings or trade without planning.

Start with paper trading or small trades to learn the process. Read market trends, understand option pricing, and always use protective measures. With time and practice, option selling can become a strong part of your trading journey.

✅ Summary at a Glance

- Option selling earns you premium by taking risk.

- It includes call and put selling.

- Most options expire worthless , this benefits the seller.

- Risk management is very important.

- Needs a margin account and higher capital.

- Common strategies: Covered Call, Naked Put, Iron Condor.

- Profits are taxable and regulated.

- Great for regular income if done with care.